How do I start?

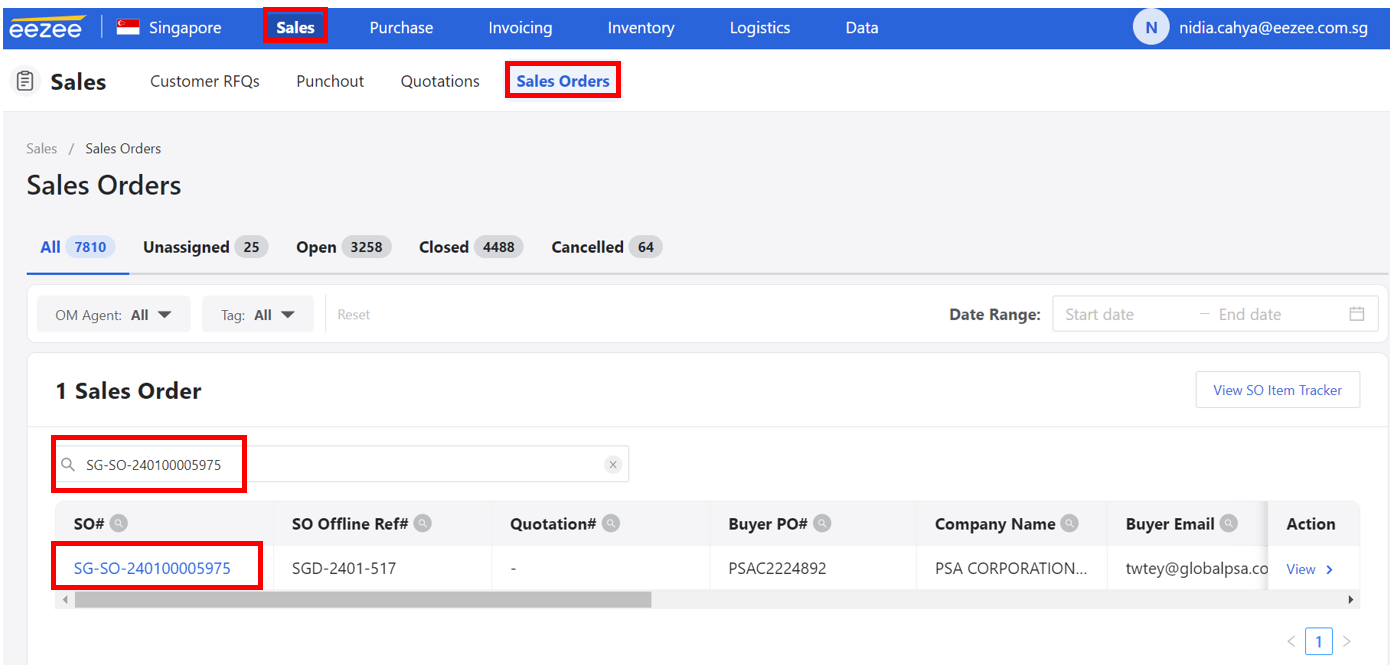

Step 1. Go to Sales, click Sales Orders, search the SO (Sales Order) Reference, and click the SO#.

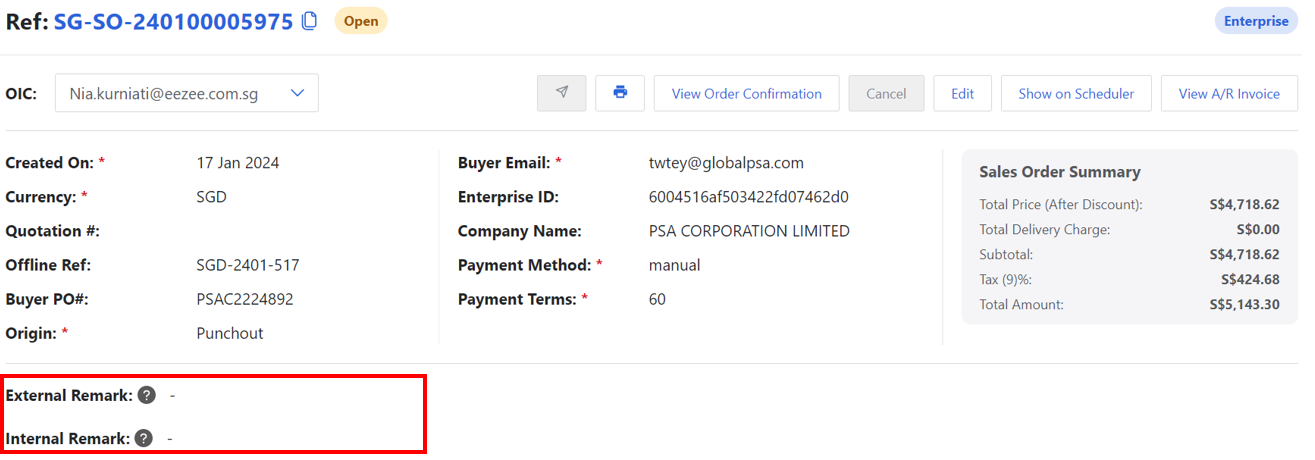

Step 2. Before creating the PO (Purchase Order), please check the following:

A. SO (Sales Order) External and Internal Remark to see if there are any notes from the client.

E.g.: Delivery should be done before Chinese New Year.

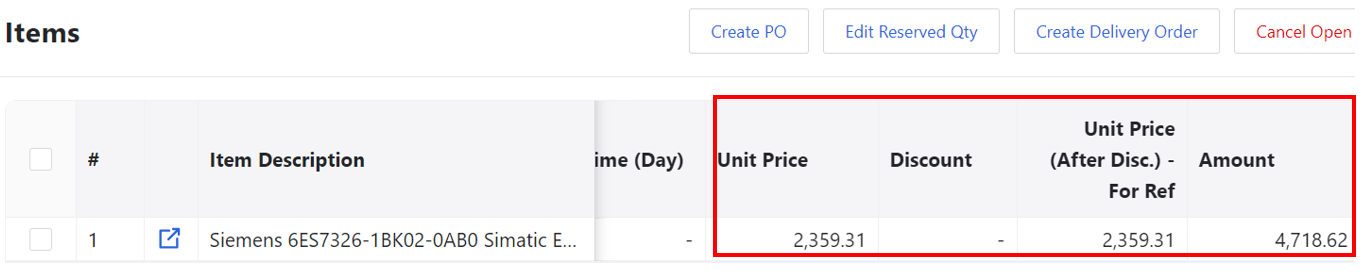

B. Check SO Unit Price, Discount, Unit Price (After Disc.) – For Ref & Amount to see if the SO Unit Price has a discount.

Go to step 6 to see what to do if there’s a bulky discount.

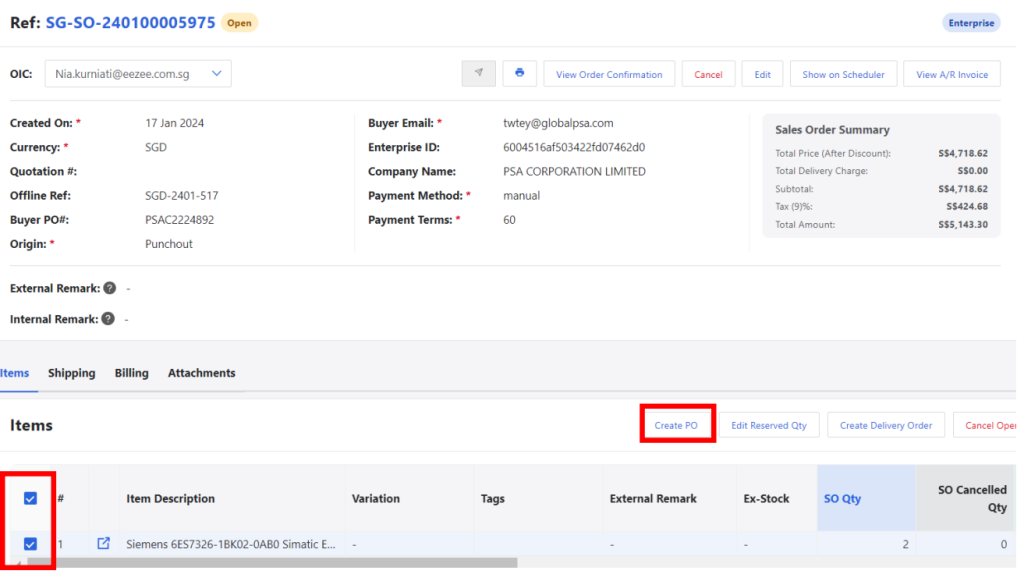

Step 3. On the SO (Sales Order) page, create the PO (Purchase Order) by ticking the check box beside the item description then click “Create PO” button. You will be redirected to PO (Purchase Order) page.

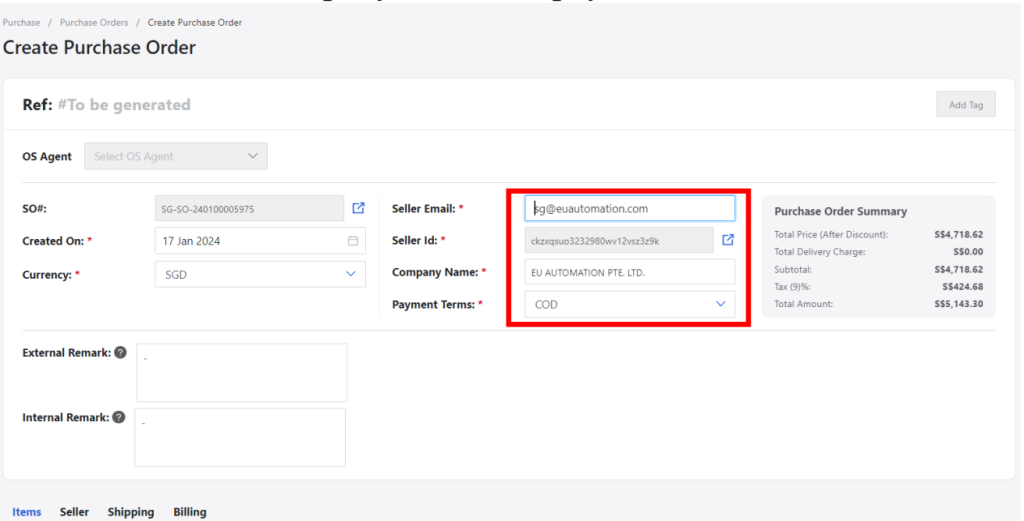

Step 4. Fill in the seller email that is registered on Sourcing Tools. Make sure email, company name, and payment terms are correct.

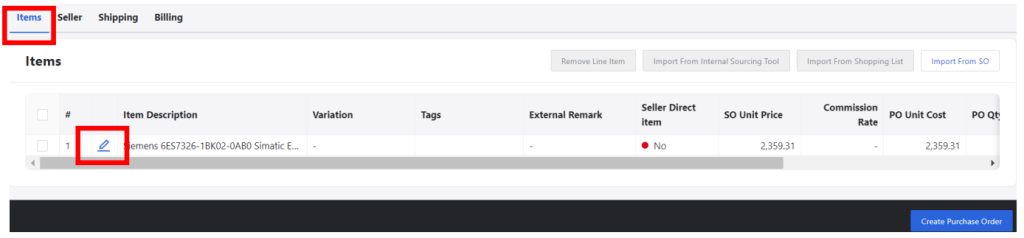

Step 5. Click on “Items” and edit the PO (Purchase Order) unit cost by clicking the pen icon.

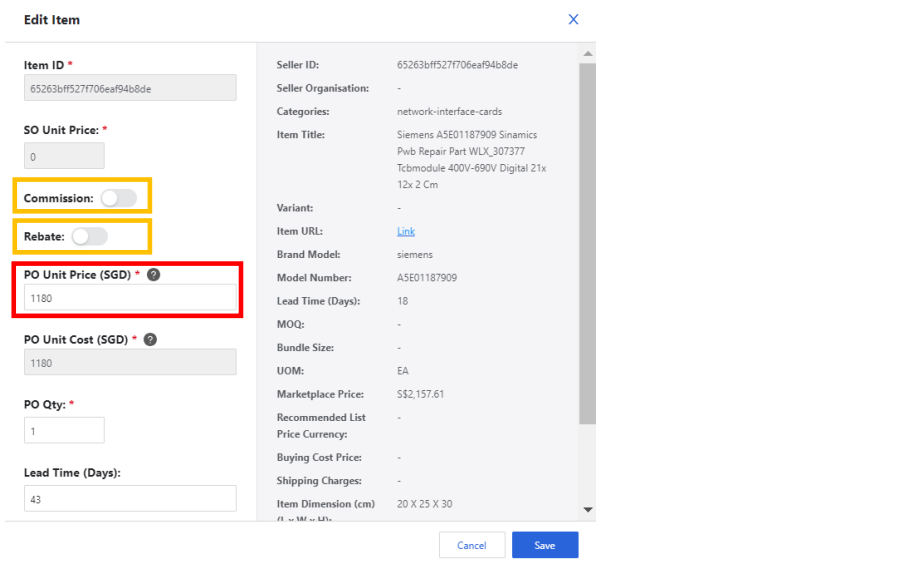

Step 6. Fill in the following details:

– PO Unit Price (SGD) (Fulfill if the item is ETH (Eezee Trading House) / If the OM team member is able to negotiate with supplier to get a cheaper price)

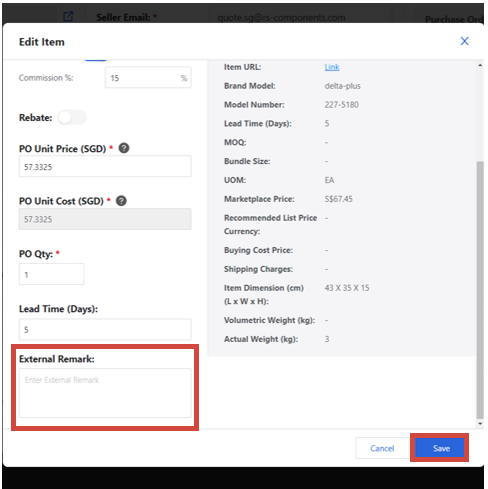

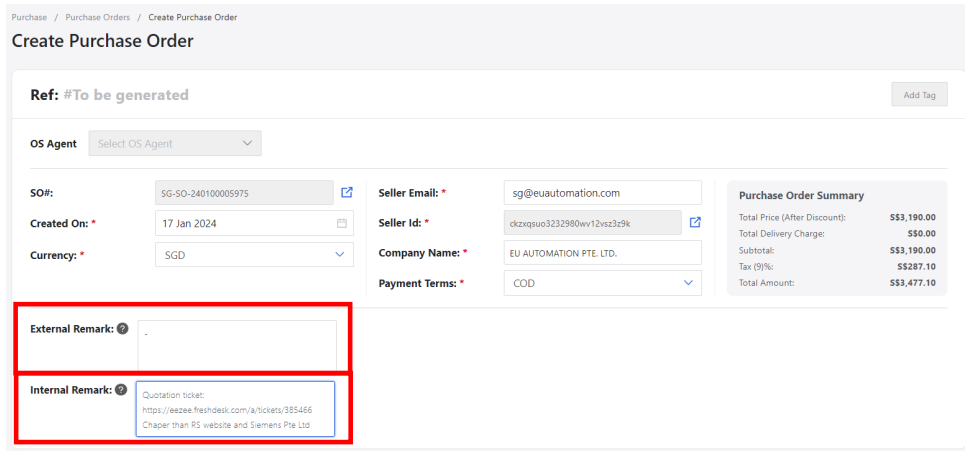

– Commission (Activate commission if Supplier is a Direct Supplier with Commission Fee)

– Rebate (Activate rebate if Supplier is a suppliers that require us to indicate gross amount at the PO and/or their invoice is in gross amount)

– If there’s a bulky discount, please indicate the discount in the PO Line Item Internal Remark. (Next step after step 2 point B).

E.g.: 5% Bulky Discount

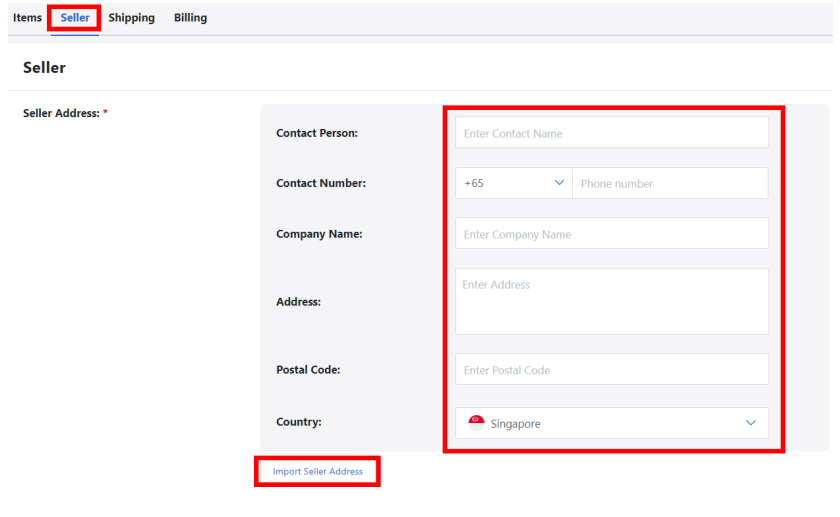

Step 7. Click “Seller“ and fill in the details by clicking “Import Seller Address” button.

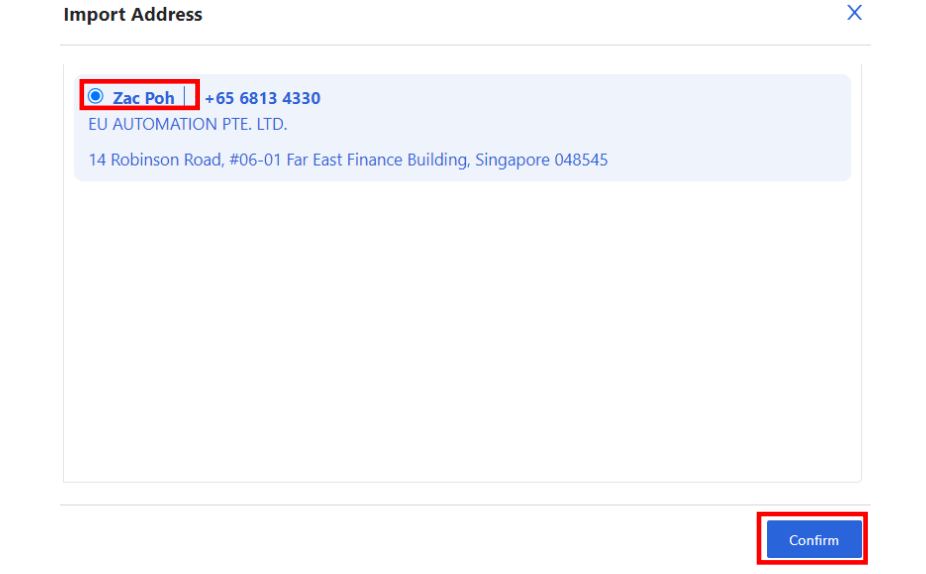

Step 8. Tick the radio button and click “Confirm“.

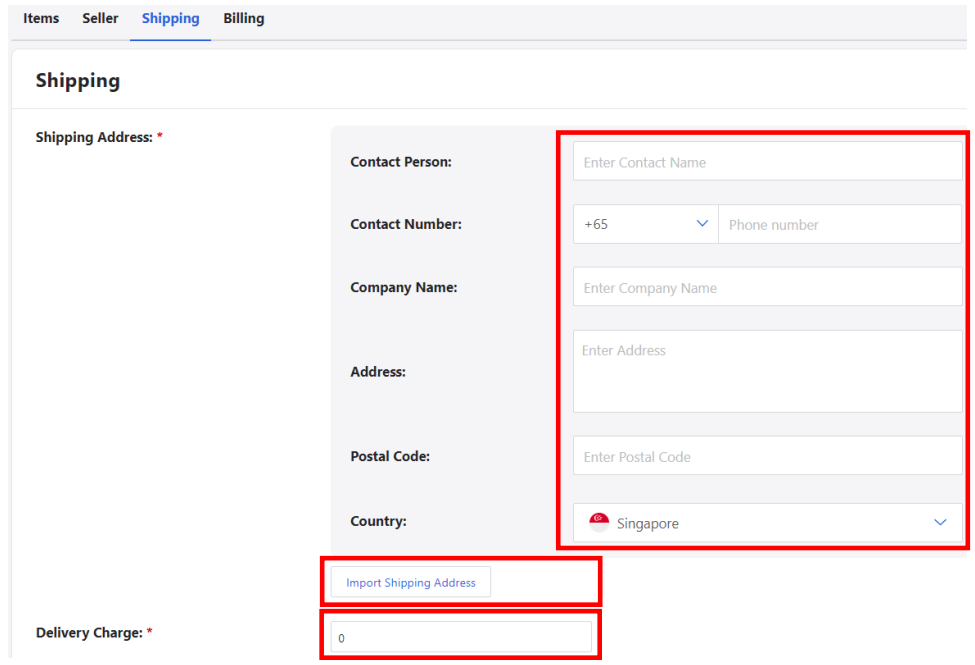

Step 9. Click “Shipping“ and fill in the details by clicking “Import Shipping Address” button.

You may also add the delivery charge if there’s any.

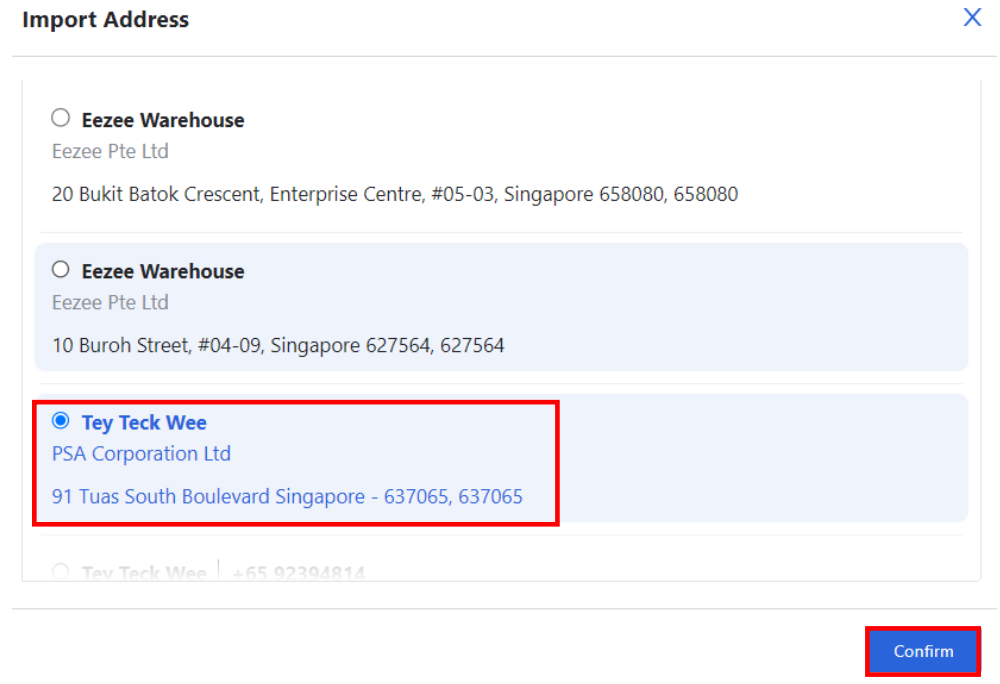

Step 10. If the order should be delivered directly to the customer’s location by the supplier, ensure that the shipping address is exactly the same as per shipping address on the SO (Sales Order). Otherwise, select Eezee Warehouse. Click “Confirm“.

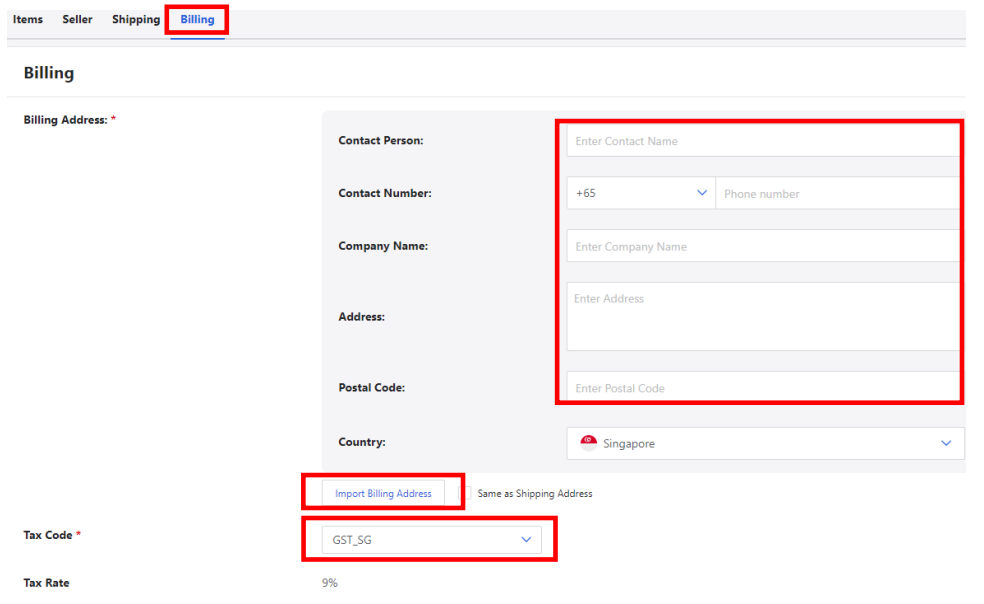

Step 11. Go to “Billing“ and click “Import Billing Address” button.

On this part you will be able to change the GST/Tax rate to 9% or 0%.

Step 12. If the order is from a quotation, add an external remark such as “Note that the price stated above is based on your last quotation on dd/mm/yyyy”. Add the quotation link or any note related to the order in the internal remark box.

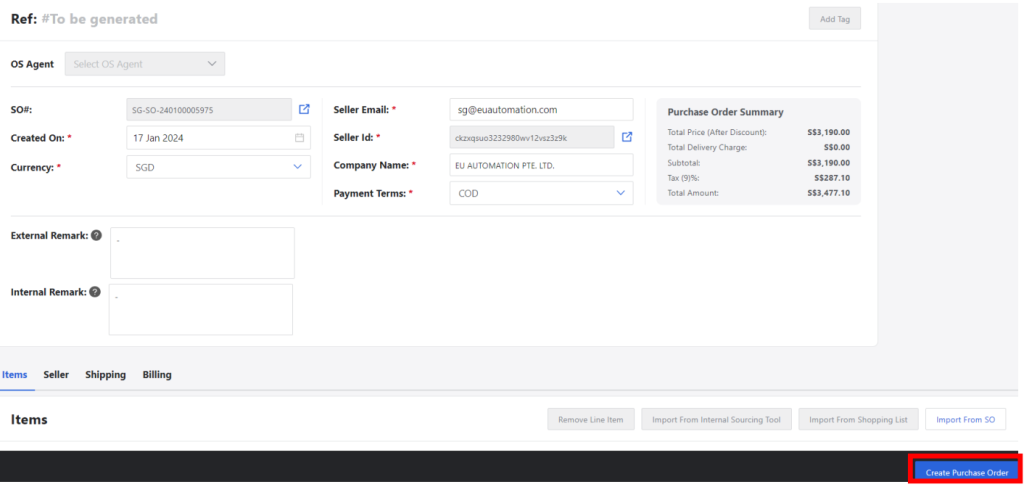

Step 13. Click “Create Purchase Order” button.

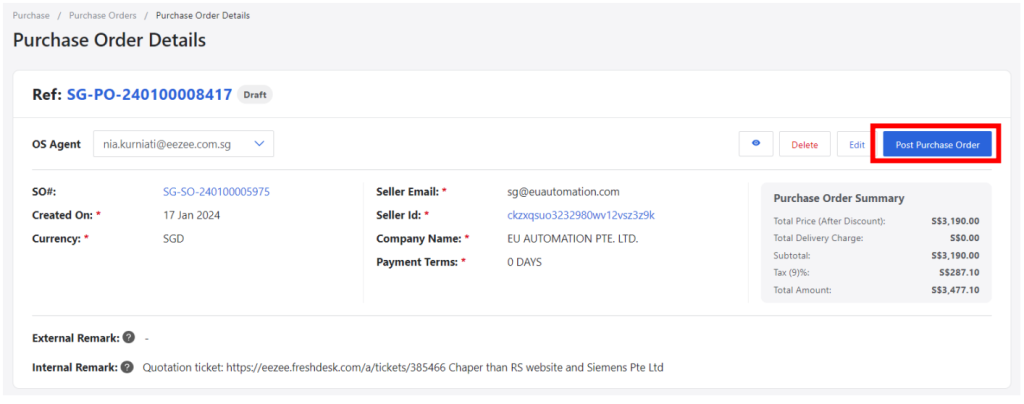

Step 14. Click “Post Purchase Order”.

Wait for the PO to be approved within 5-15 minutes.

One Comment